The U.S. healthcare system is different from other developed countries because it doesn’t offer universal coverage. Instead, it combines government-funded programs like Medicare and Medicaid with private insurance plans, creating a complex system. This article gives an overview of how the American health system works, its challenges, and possible solutions. Additionally, it examines the health system from a generational perspective, highlighting how each generation faces unique challenges and needs in accessing and managing healthcare.

The Healthcare System in America

The U.S. health system is characterized by a mix of public and private, for-profit and nonprofit insurers and healthcare providers3. The federal government plays a significant role by funding Medicare, a national program for adults aged 65 and older and some individuals with disabilities, as well as programs for veterans and low-income individuals, including Medicaid and the Children’s Health Insurance Program3. States also play a crucial role in managing and paying for aspects of local coverage and safety net programs3.

However, private insurance remains the dominant form of coverage in the U.S., primarily provided by employers3. This employer-based system, with its roots in World War II labor shortages, creates challenges such as job lock and fragmentation of healthcare finance4.

According to 2019 data, approximately 50% of Americans receive health insurance through their employers2. Another 6% obtain private insurance through health insurance marketplaces, while 20% rely on Medicaid and 14% on Medicare2. Despite these coverage options, a significant portion of the population, around 9%, remains uninsured2.

The private insurance industry in the U.S. operates by negotiating contracts with healthcare providers, including physicians, hospitals, and pharmacies5. These contracts often involve fixed fees for services, with insurance companies leveraging their large pool of insured patients to restrict payments to providers who agree to these terms5.

Furthermore, the U.S. healthcare system is not a monolithic entity but rather comprises several systems serving different segments of the population6. These include programs for veterans through the Veterans Health Administration and services for Native Americans through the Indian Health Service. This fragmentation adds to the complexity of the American healthcare system6.

Cost

The cost of healthcare in America is a significant concern. In 2023, U.S. healthcare spending reached $4.9 trillion, or $14,570 per person12. This represents a 7.5% increase from the previous year and accounts for 17.6% of the nation’s Gross Domestic Product (GDP)13. Several factors contribute to these high costs, which can be broadly categorized as demand-side and supply-side factors: On the demand side, an aging population is increasing the need for health services, contributing to higher overall spending. On the supply side, several factors are at play, including the rising prices of medical goods and services, such as prescription drugs and hospital care. Administrative complexity also adds to costs, as managing a system with multiple payers and providers involves significant expenses. Additionally, while technological advancements improve patient care, they often come with high costs.

In 2019, national health expenditures totaled $3,795 billion (in nominal dollars), with personal healthcare expenditures accounting for approximately 85% of this spending16. Examining these expenditures in constant dollars (adjusted for inflation) reveals a 30% increase in total national health expenditures and a 31% increase in personal healthcare expenditures between 2009 and 201916.

The high cost of healthcare can create financial burdens for individuals and families, leading to medical debt and difficulty affording necessary care15. Studies have shown that out-of-pocket spending per person has risen significantly over the years, from $115 in 1970 to $1,425 in 2022 (adjusted for inflation)15.

Quality

Despite the high expenditure on healthcare, the quality of medical care in America does not consistently outperform other developed nations17. While the U.S. has many of the world’s finest medical professionals, academic health centers, and research institutions18 there are concerns about inconsistencies in quality and disparities in access to care18.

Public perception of health services quality in America has been declining. In 2024, only 44% of U.S. adults rated the quality of these services as excellent or good, a significant drop from the majorities observed between 2001 and 202019. Furthermore, Americans rate healthcare coverage even more negatively than they rate quality19.

The negative perception of the U.S. health system is reflected in declining evaluations of the quality of care that Americans personally receive. While the U.S. excels in certain areas, such as mortality rates within 30 days of acute hospital treatment, it lags behind other developed countries in overall performance and equity. Key issues contributing to this gap include the underuse of services, where many Americans miss out on necessary preventive care or treatment for chronic conditions, leading to avoidable health problems. On the other hand, overuse of services occurs when patients receive unnecessary or excessive medical interventions, driving up costs and potentially causing harm. Misuse of services, such as medical errors and preventable adverse events, further undermines patient safety. Additionally, there is significant variation in healthcare utilization and treatment patterns across different regions and populations, indicating inconsistencies in quality and access. Disparities in healthcare quality also persist based on race, ethnicity, socioeconomic status, and geographic location.

Access

Access to healthcare in the United States is influenced by various factors, including health insurance coverage, affordability, and availability of services. While the Affordable Care Act expanded insurance coverage, a significant portion of the population remains uninsured or underinsured22.

High out-of-pocket costs, even for those with insurance, can deter individuals from seeking necessary care23. Concerns about affordability may lead to delayed or forgone care, potentially exacerbating health conditions and increasing costs in the long run24. This financial barrier to care is particularly pronounced in the U.S. compared to other developed countries25.

Inadequate health insurance coverage and high out-of-pocket costs contribute to individuals delaying or forgoing essential care, such as doctor visits, dental care, and medications26. This can lead to adverse health outcomes and increased medical debt for both insured and uninsured individuals26.

Geographic barriers also play a role in medical services access. Rural communities often face shortages of medical providers and limited access to specialized services24. This disparity in access contributes to health inequities and highlights the need for targeted interventions to improve accessibility in underserved areas.

Major Challenges

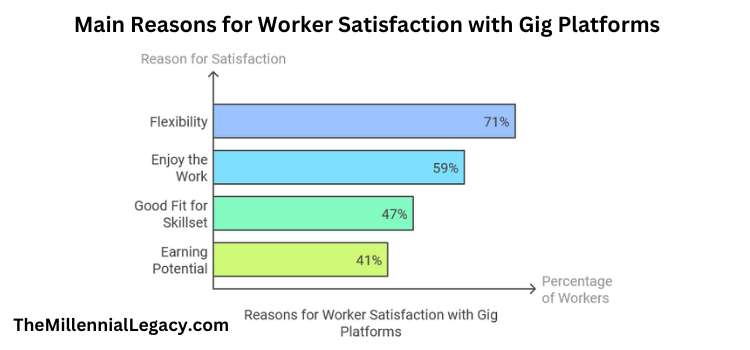

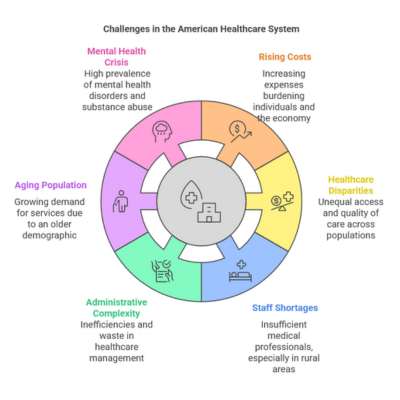

The American medical system faces numerous challenges that require attention and potential solutions. Some of the major challenges include:

- Rising Costs: The increasing cost of health services and prescription drugs poses a significant burden on individuals, families, and the overall economy27.

- Healthcare Disparities: Disparities in access to care and quality of care persist across different populations, contributing to health inequities28.

- Staff Shortages: The healthcare industry faces shortages of nurses, physicians, and other medical professionals, particularly in rural areas29.

- Administrative Complexity: The administrative burden associated with managing a complex health system with multiple payers and providers is substantial4. Data suggests that 25% of healthcare spending is wasted due to inefficiencies and failures in care delivery, including overtreatment, pricing failures, and administrative complexity4.

- Aging Population: The aging U.S. population increases the demand for health services, putting a strain on resources and potentially driving up costs27.

- Mental Health Crisis: The prevalence of mental health disorders and substance abuse presents a significant challenge to the health system30.

Addressing these challenges requires a comprehensive approach that involves policy changes, technological innovations, and a focus on improving efficiency and quality of care.

Potential Solutions to the Challenges

Several potential solutions could help address the challenges facing the American healthcare system:

- Expanding Insurance Coverage: Increasing access to affordable health insurance through various mechanisms, such as expanding Medicaid eligibility or creating a public option, could reduce the number of uninsured individuals31.

- Controlling Costs: Implementing strategies to control the rising cost of medical services and prescription drugs, such as negotiating drug prices or promoting value-based care, could help make healthcare more affordable32. One approach could involve utilizing taxpayer money more efficiently to promote the most cost-effective delivery of health services32.

- Addressing Disparities: Investing in programs and policies that address social determinants of health and reduce disparities in access to care could improve health equity31.

- Increasing the Workforce: Expanding training programs, offering loan forgiveness programs, and streamlining licensing processes could help address healthcare staffing shortages31.

- Improving Efficiency and Quality of Care: Promoting the use of technology, such as telehealth and electronic health records, and implementing quality improvement initiatives could enhance efficiency and patient outcomes33. Telehealth, in particular, offers a promising avenue for expanding access to care, especially in rural areas where healthcare providers may be scarce23.

- Investing in Preventive Care: Focusing on preventive care and public health initiatives could help reduce the incidence of chronic diseases and improve overall health outcomes32. Increasing access to primary and preventive care could potentially reduce the demand for more expensive emergency care32.

Generational Perspective

The American healthcare system is designed to cater to a diverse population, but it still faces a huge challenge in meeting the unique needs of each generation. From the digital natives of Generation Z to the older Silent Generation, each group faces distinct health challenges, access issues, and healthcare expectations. Let’s now look at each generation to better understand these differences and the healthcare needs they face.

Gen Z: The Digital Natives

Gen Z, born between 1997 and 2012, is the first generation to grow up fully immersed in the digital age. As a result, their healthcare preferences are shaped by technology. They value convenience and efficiency, often opting for telemedicine and mobile apps to manage their health. Mental health is a significant concern, with anxiety and depression being common among Gen Z. However, financial challenges and a distrust of healthcare providers are barriers they face, leading them to seek more urgent and virtual care than older generations. As they transition to independent healthcare coverage, they face high uninsured rates and lack health insurance literacy, further complicating access to care.

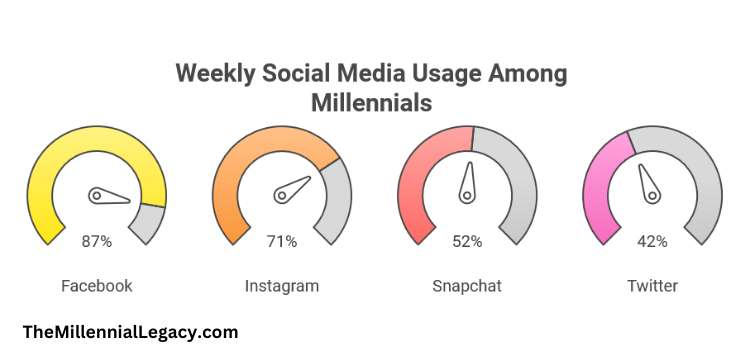

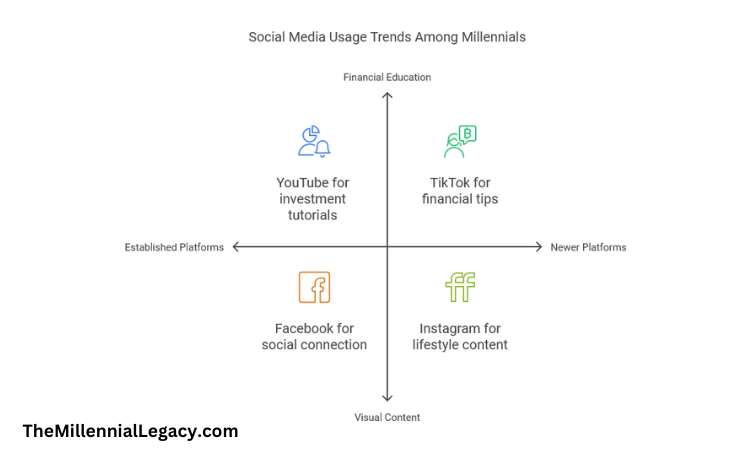

Millennials: Tech-Savvy and Health-Conscious

Born between 1981 and 1996, Millennials make up the largest segment of the U.S. workforce. They are known for their preference for personalized healthcare experiences and their reliance on technology. In terms of Millennials health, This generation has a higher prevalence of chronic conditions like diabetes, depression, and high blood pressure compared to previous generations at the same age. Millennials also emphasize mental health, seeking holistic approaches that include emotional support, better sleep, and work-life balance. Despite improvements in healthcare coverage under the Affordable Care Act, Millennials still face financial burdens due to high deductibles and a lack of primary care physicians.

Gen X: The Sandwich Generation

Gen X, born between 1965 and 1980, often finds itself balancing the responsibilities of caring for both children and aging parents, earning it the nickname “sandwich generation.” This group faces a high prevalence of chronic conditions such as cardiovascular disease and mental health issues. They also experience work-related stress, which negatively impacts their overall health. While Gen X generally relies on traditional healthcare models, they are open to alternatives like telehealth and retail clinics. As they age, Gen X will need more support in managing chronic conditions and mental health.

Baby Boomers: The Caretakers

Baby Boomers, born between 1946 and 1964, represent a large and aging segment of the population. As they enter their senior years, they face an increased burden of chronic diseases, including hypertension, arthritis, and diabetes. Baby Boomers are more likely to rely on Medicare, but the rising cost of healthcare, particularly long-term care, poses significant financial challenges. Geriatric care will become more essential for this generation, as they experience mobility limitations and cognitive decline. With healthcare systems facing staffing shortages, particularly in geriatrics, Baby Boomers require more specialized care.

The Silent Generation: Traditional Care Seekers

The Silent Generation, born between 1928 and 1945, is the oldest generation still actively seeking care. They often prefer traditional healthcare models and have a strong relationship with their healthcare providers. However, their limited familiarity with technology can hinder access to digital health solutions. As this generation ages, the demand for geriatric care and long-term care services will increase. Effective communication, especially with regard to complex medical explanations, is key to engaging the Silent Generation in their care.

Disparities Across Generations

Each generation faces unique healthcare challenges, but disparities in access and outcomes exist. For example, Gen Z is more likely to avoid seeking mental health treatment, despite higher prevalence rates, compared to Millennials. Similarly, Gen X has higher rates of chronic diseases than Baby Boomers did at the same age. Addressing these disparities requires a focus on improving access to care, reducing healthcare costs, and promoting health equity.

As we look to the future, the American healthcare system will need to adapt and evolve to meet the growing and changing needs of each generation and the generations to come. By focusing on innovative solutions, expanding access to care, and addressing the unique challenges faced by different age groups, we can work towards a more inclusive and efficient system. The journey to a better healthcare system may be complex, but it starts with understanding the diverse needs of our population and striving for greater equity and quality in care for all.

Sources

- https://en.wikipedia.org/wiki/Healthcare_in_the_United_States

- https://www.ispor.org/heor-resources/more-heor-resources/us-healthcare-system-overview/us-healthcare-system-overview-background-page-1

- https://www.commonwealthfund.org/international-health-policy-center/countries/united-states

- https://www.goinvo.com/vision/us-healthcare-problems/

- https://www.umaryland.edu/media/umb/oaa/campus-life/ois/documents/Guide-to-U.S.-Healthcare-System.pdf

- https://eurohealthobservatory.who.int/publications/i/united-states-health-system-review-2020

- https://www.webmd.com/health-insurance/types-of-health-insurance-plans

- https://www.investopedia.com/types-of-health-insurance-7486292

- https://www.northwesternmutual.com/life-and-money/the-most-common-types-of-health-insurance/

- https://www.uhc.com/understanding-health-insurance/types-of-health-insurance

- https://www.usa.gov/health-insurance

- https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/historical

- https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/historical#:~:text=U.S.%20health%20care%20spending%20grew,spending%20accounted%20for%2017.6%20percent.

- https://www.aamcresearchinstitute.org/our-priorities/health-care-costs

- https://www.kff.org/health-policy-101-health-care-costs-and-affordability/

- https://www.cdc.gov/nchs/hus/topics/health-care-expenditures.htm

- https://www.healthsystemtracker.org/chart-collection/quality-u-s-healthcare-system-compare-countries/

- https://www.ahrq.gov/patient-safety/quality-measures/21st-century/index.html

- https://news.gallup.com/poll/654044/view-healthcare-quality-declines-year-low.aspx

- https://news.gallup.com/poll/468176/americans-sour-healthcare-quality.aspx

- https://www.kff.org/slideshow/how-does-the-quality-of-the-u-s-healthcare-system-compare-to-other-countries/

- https://www.cdc.gov/dhdsp/health_equity/health-care-access.htm#:~:text=Health%20care%20affordability%20also%20affects,cardiovascular%20risk%20factors%20remain%20uninsured.

- https://healthadministrationdegree.usc.edu/blog/how-to-improve-access-to-health-care

- https://www.cdc.gov/dhdsp/health_equity/health-care-access.htm

- https://www.commonwealthfund.org/publications/journal-article/2016/nov/new-survey-11-countries-us-adults-still-struggle-access-and

- https://odphp.health.gov/healthypeople/priority-areas/social-determinants-health/literature-summaries/access-health-services

- https://www.ahdbonline.com/issues/2023/september-2023-vol-16-payers-guide/challenges-facing-the-us-healthcare-system-in-2023-and-beyond-a-payer-perspective

- https://www.wolterskluwer.com/en/expert-insights/five-key-barriers-to-healthcare-access-in-the-united-states

- https://healthcarecouncil.com/identifying-challenges-facing-the-u-s-healthcare-system/

- https://www.netsuite.com/portal/resource/articles/erp/healthcare-industry-challenges.shtml

- https://www.ama-assn.org/health-care-advocacy/access-care/5-ways-improve-access-health-care

- https://giesbusiness.illinois.edu/news/2023/08/28/what-approaches-can-help-improve-the-us-healthcare-system

- https://odphp.health.gov/healthypeople/objectives-and-data/browse-objectives/health-care

- https://www.panfoundation.org/app/uploads/2024/03/State-of-Patient-Access-Focus-Brief-Generations-PAN-Foundation.pdf

- https://www.experian.com/blogs/healthcare/how-do-different-generations-react-to-healthcare-costs/

- https://www.peoplekeep.com/blog/how-millennials-and-gen-z-are-changing-health-insurance

- https://ezra.com/blog/impact-millennials-healthcare