For many people, adulthood doesn’t arrive with a mortgage or a baby announcement—it arrives the day you ask, “Wait… who pays for this if my apartment floods?”

Welcome to the world of renter’s insurance. It’s one of those grown-up responsibilities that doesn’t get the same attention as health coverage or retirement planning, but if you’re renting, it might be the smartest small decision you make.

Let’s start with when renting is most common—and who it affects.

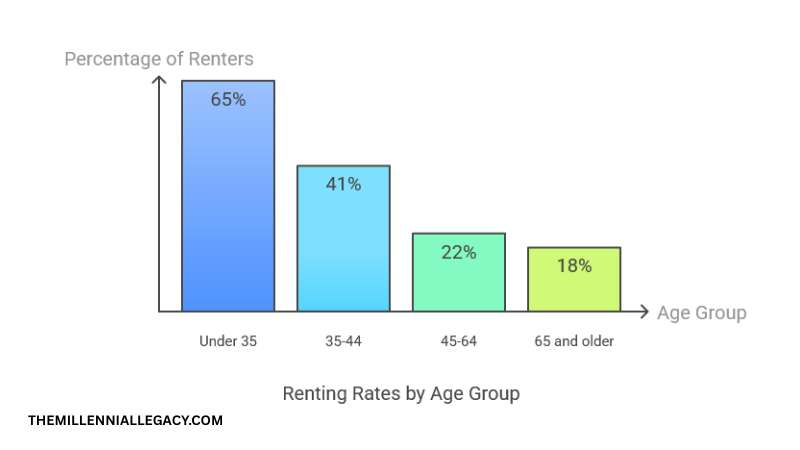

📊 According to the U.S. Census Bureau, 36% of U.S. households were renting their homes as of 2023. But renting isn’t spread evenly across the population.

📊 When looking at the different age groups, among adults under 35, nearly 65% are renters, compared to 41% of those ages 35–44, and just 22% of those 45–64. For those 65 and older, renting drops to about 18%.

From a generational point of view, this means that Gen Z and Millennials are the generations that make up the largest portion of renters in the U.S.—and yet, these same groups are often the least likely to carry protection for the space they call home.

These younger generations are often digital-first, subscription-savvy, and cost-conscious. But despite those instincts, renter’s insurance still tends to fall through the cracks.

What Renter’s Insurance Actually Is

Despite what some assume, renter’s insurance doesn’t cover the building you live in—that’s your landlord’s job. What it covers is everything inside your space: your stuff, your liability, and your ability to stay somewhere else if something goes wrong.

A typical renters insurance policy includes:

- Personal property coverage: Things like electronics, clothes, and furniture

- Liability protection: If someone gets injured in your apartment and sues

- Additional living expenses: If a fire or water damage forces you to move temporarily

It’s basic, but it’s powerful.

But Is It Worth It?

📊 The average renter owns more than $30,000 in personal belongings (source).

📊 And yet, only 57% of renters in the U.S. have a policy in place—compared to 88% of homeowners.

Why the gap?

Some renters assume their landlord’s insurance covers them. Others don’t think their belongings are valuable enough. And many simply don’t realize how low the cost is.

📊 The national average cost of renters insurance is just $14 per month, or $168 per year (source).

What Does It Cover (And What Doesn’t It)?

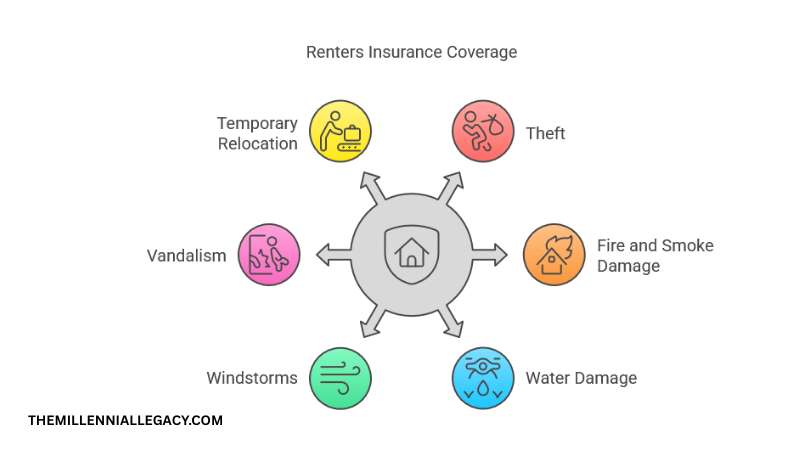

A renters insurance policy typically covers:

- Theft

- Fire and smoke damage

- Water damage (from burst pipes, not floods)

- Windstorms

- Vandalism

- Temporary relocation expenses

It also offers liability protection if someone gets hurt in your home or you accidentally cause damage to someone else’s property (think: water leaks into your downstairs neighbor’s apartment).

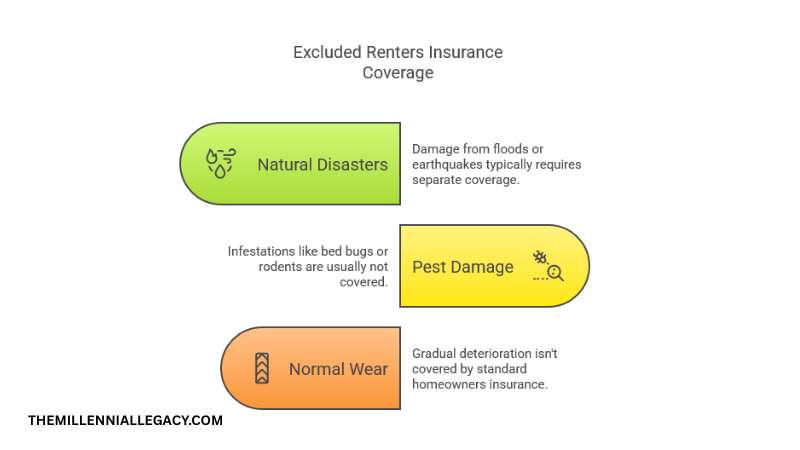

But policies usually don’t cover:

- Floods or earthquakes (unless you buy separate coverage)

- Pest damage (like bed bugs or rodents)

- Normal wear and tear

If you own high-value items like an engagement ring or rare collectibles, you may need to add scheduled personal property coverage for full protection.

What Happens If You Don’t Have It?

Without coverage, any damage, loss, or liability falls on you. That means:

- Replacing everything out of pocket after a fire or break-in

- Covering legal expenses if someone sues you for an injury

- Paying for hotel stays if your place becomes unlivable

📊 In 2022, 1 in 20 insured homes filed a property damage claim. Renters aren’t immune to those same risks—they just don’t always prepare for them.

What It’s Like to File a Claim

Let’s say your apartment is broken into while you’re at work. Your laptop, gaming console, and a few pieces of jewelry are stolen—total value, about $3,200.

You file a police report and notify your insurer. After confirming your deductible (say, $500), the company pays the difference—$2,700—within a few days or weeks.

That’s a smoother outcome than paying $3,200 out of pocket with no recourse.

How Much Coverage Do You Actually Need?

Start by adding up the value of everything you own. You might be surprised by how quickly it adds up.

📊 A 2023 Zillow survey found that most renters underestimate the value of their belongings by 30–50%.

You’ll also want to choose:

- A deductible you can comfortably pay out of pocket

- Liability protection (typically $100,000+)

- Additional living expenses coverage (especially if you live in a large metro area where hotels are costly)

Common Myths About Renter’s Insurance

“My landlord’s insurance will cover my stuff.”

Nope—it only covers the building.

“My stuff isn’t worth that much.”

See above—once you tally furniture, electronics, clothing, kitchenware, it adds up fast.

“It’s too expensive.”

Most policies cost less than a streaming subscription.

“I’ll worry about it later.”

By then, it might be too late.

Why It’s Often Required—And Still Overlooked

📊 According to a 2023 NMHC/Kingsley survey, 78% of landlords now require tenants to carry renters insurance before move-in.

And yet, many renters still skip it after move-in, especially in smaller buildings where enforcement is weak.

Getting it checked off early is a simple way to protect your lease—and your lifestyle.

How to Shop for a Policy

Here’s what to look for when comparing renters insurance quotes:

- Coverage limits: Match to the value of your stuff

- Deductibles: Balance affordability and risk

- Policy features: Look for liability, property, and displacement coverage

- Claim process: Read reviews on claim handling before choosing

- Bundling discounts: May be available if you already have auto insurance

Final Thought: A Quiet Safety Net

Renter’s insurance doesn’t scream “adulting win,” but it is one.

“You don’t need to own the building to take ownership of what’s inside it.”

Whether you’re living solo, with roommates, or raising a family, renter’s insurance is a small investment that protects you when the unexpected shows up uninvited.